Seacoast NH Real Estate Market Data & Trends

Seacoast, NH Real Estate Market Data & Trends - Q1/2026

As a Seacoast realtor with a background in IT Analysis, I like to go above and beyond sending potential home sellers a basic generated home value number. I like to take a deeper drive into the data, and present multiple methods in hopes to find correlation and further support our pricing strategy. Here is the current state of the Rockingham County market.

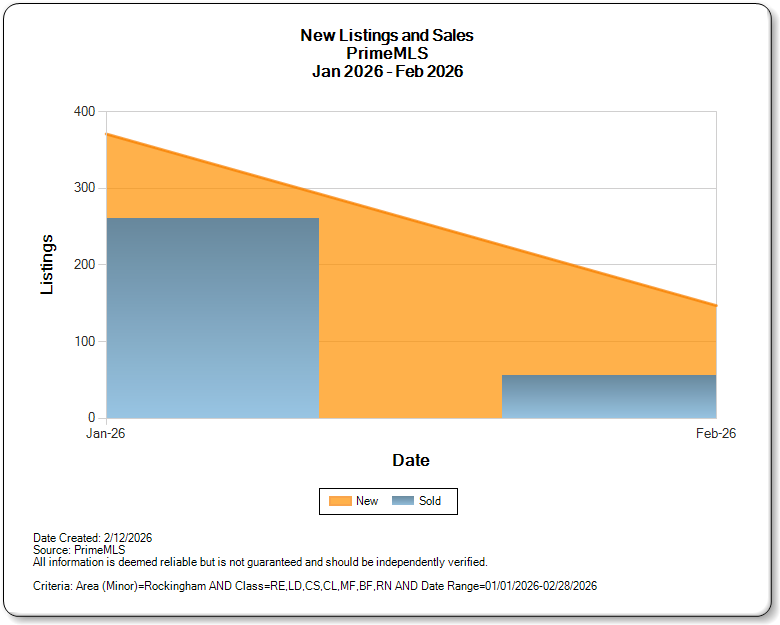

Seacoast NH Real Estate Listings vs Sales Jan-Feb

While not a surprise as winter months on the Seacoast NH Real Estate market continues to show low inventory, with

The Town-by-Town Comparison

| Town | Median Price (2026) | Inventory Status | Best For |

| Portsmouth | $763,866 | Extremely Tight | Walkability & Tech Hub |

| Rye | $1,198,048 | Low/Luxury | Waterfront & Privacy |

| Hampton | $645,816 | Increasing | Beach Access & Commuters |

| Seabrook | $645,816 | Stable | Value & Retail Access |

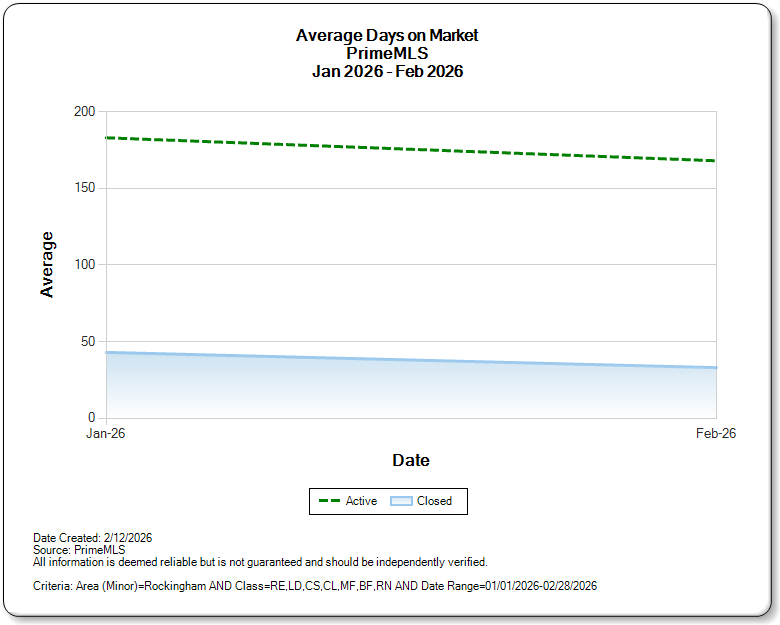

Current Days on Market (DoM) in Rockingham County

Average Days On Market

While there isn't a lot of data yet in Q1 to properly form an analysis. You can see that the DoM continues to decline. This can mean 1 of 2 things - Homes are increasingly being priced at values that Buyers see desirable, or that we are having price drops, showing values were too high, properties sat in January, and eventually were reduced to a price that was deemed fair by Buyers.

Property Type Comparison

This helps you rank for “Seacoast condo market vs single family.”

| Property Type | Avg. Price | Avg. Days on Market | Market Sentiment |

| Single Family | $710k | 18 Days | High Competition |

| Condominiums | $415k | 25 Days | Balanced |

| Luxury ($1.5M+) | $2.1M | 45 Days | Selective |

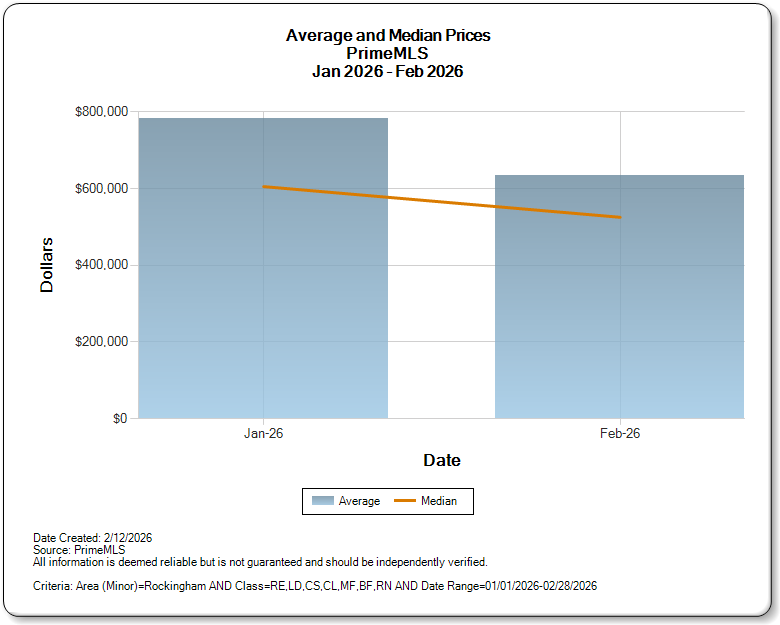

The "Seacoast, NH, Market Sentiment" Analysis

While Seacoast inventory remains historically lean, the market is beginning to “breathe” again as we approach the spring surge. Here is the 2026 outlook at a glance:

The “Rate Swap” Effect: As the Fed moves toward rate reductions, we expect “locked-in” sellers to finally list, allowing them to trade into new homes without a significant jump in monthly costs.

The Renter Shift: High local rents are driving a wave of first-time buyers toward homeownership as a more stable financial hedge.

Stable Growth: We have moved past the volatile 2021–2024 price spikes. Expect healthy, sustainable value increases of approximately 2% year-over-year.

A “Flight to Quality”: Today’s buyers are paying top-dollar and, in return, are demanding perfection. Turn-key properties in prime locations like Rye, Portsmouth, and New Castle continue to command premium interest.

The Bottom Line: We aren’t in a “boom” or a “break”—we are in a period of strategic stability. For sellers, presentation and precise pricing are now more critical than ever to capture a discerning buyer pool.